The automotive industry serves as the largest manufacturing sector of the U.S. economy. Any disruption within the supply chain of this industry creates a meaningful impact on the economy and on the consumer price indices (CPI). Beginning in 2020 with the pandemic, factory shutdowns and semiconductor chip shortages led to a crisis in the automaker industry and a surge in car prices. Now that we are in the opening months of 2024, how do car prices compare with recent changes in inflation?

Due to Covid-19, much manufacturing around the world ground to a halt as factories closed. In the automaker industry, semiconductor chip shortages led car manufacturers to produce less cars. In the aftermath, as the economy reopened, there was an increase in the demand for both used and new cars. This, combined with supply problems, led to price hikes by dealerships for the existing inventory and a dramatic uptick in car prices.

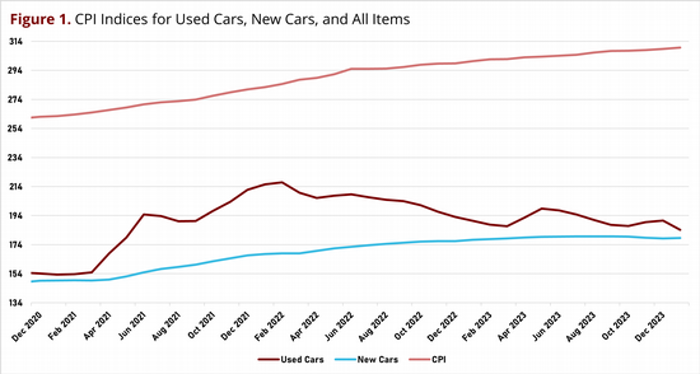

The Bureau of Labor Statistics publishes consumer price indices that tracks prices paid by consumers for new and used vehicles. The figure below shows the rising trend of the overall price level (i.e., the CPI), as well as the subindices of the CPI for used cars and for new cars. The data in the figure runs from December 2020 through January 2024.

From December 2020 to December 2021, car prices soared, spiking far higher than the already-high level of CPI inflation. New car prices increased by 11.7% and used cars increased by 37.2%. Meanwhile, overall inflation during the same time span was 7.1%. So car prices rose much faster than the overall increase in prices.

The following year, new car price increases were more in line with the rise in overall prices, while used car prices actually fell compared to the prior year. The price change from December 2021 to December 2022 for new cars was an increase of 5.8% but used cars prices fell by 8.8%. For comparison, the overall price level (the CPI) increased by 6.4%.

Car prices continued their upward trend, but slowed, between December 2022 and December 2023. This was a period in which the economy was expanding more and supply bottlenecks loosened. The price of new cars rose by a mere 1%, and used cars fell again, but this year by 1.2%. Meanwhile the overall price index increased by 3%. Compared to other prices, car prices rose less or even fell.

For the first month of 2024, vehicle prices continued to moderate. From December 2023 to January 2024, the CPI for new cars fell by 0.04%. The CPI for used vehicles fell more dramatically, 3.4%. During this one month, the overall CPI increased 0.3%. It seems that vehicle prices will continue to hold steady, or even decline slightly, in the coming months of 2024.

Looking back to the beginning of our three year period, automobile prices have both risen sharply and declined somewhat sharply, especially for used vehicles. The price of new vehicles in January 2024 is 19.6% higher than in January 2021. The price of used vehicles has gone through more volatile movements but, in January 2024, are 20.1% higher than in January 2021. The overall price level as measured by the CPI has increased 18% since January 2021. So, overall, car prices have risen relative to the average of all consumer prices, but in the end their increase is only one or two percentage points higher than the average increase in price of other goods and services in the economy.